Building Strong Credit as a Business Owner

Sep 30, 2024 By Triston Martin

For a lot of people who own businesses, creating and keeping a good credit record is very important for increasing and maintaining their business. This is especially so for veterans who are moving from military service to owning their own businesses. Using tools or resources such as the Experian credit report can help in the process of building up credit. This article investigates how a seasoned business proprietor manages the intricacies of establishing credit and points out essential aids accessible to others in alike circumstances.

Building Strong Credit as a Business Owner

Credit is very important for getting finance and building trust with suppliers and customers. If you have good credit, it can help get better conditions for loans, less interest rates, and more chances to do business. People who own a business after working in military service, sometimes find special difficulties when starting work outside the army environment again, creating credit commonly becomes an essential step for them. Comprehending the credit system and its operation can enable them to make educated financial choices that contribute toward business triumph.

To create good credit, continuous effort, and a strategic plan are needed. People who own businesses need to be aware of things that affect their credit scores like payment history, how much credit they use, and for how long they have had the credits. They should make it a habit to keep learning about ways by which credits are scored and understand how what they do with money can change these scores. Thus, veterans can focus on enhancing their credit profiles in a manner that matches their business objectives by doing this.

- Consideration: Credit scores can fluctuate based on credit utilization; keep balances low.

- Tip: Regularly update financial knowledge through workshops or online courses.

Utilizing the Experian Credit Report

The Experian credit report is a useful instrument for business proprietors desiring to improve their credit. It gives an all-inclusive summary of a corporation's history in terms of credit, counting the conduct regarding payments and debts that are yet to be settled. By being able to access this report, those who own businesses can pinpoint aspects that require enhancements and monitor how they advance over time. Veterans can make sure all is correct, handle any differences, and actively work to improve their credit profile by frequently checking their Experian credit report.

Besides watching over their credit report, it is good for business owners to know how to read the data shown. They need to get used to important factors like credit checks and account duration as they help in making smart choices. Making use of educational materials from Experian can additionally support them in understanding what affects their credit and how they can better enhance their scores successfully.

- Fact: A credit score can be impacted by inquiries; limit unnecessary credit applications.

- Caution: Ensure that all reported information is accurate; discrepancies should be disputed promptly.

Resources for Business Owners

There are many resources available especially to help owners of businesses build credit. The Small Business Administration, also known as SBA, provides different programs that aim to support business starters especially those who served in the military. These resources give access to funding, training courses, and a chance for guidance from experienced persons. Moreover, teaching sessions about finance can aid those who own businesses to comprehend credit ratings, the necessity of paying on time, and potent tactics for managing debt. Using these aids can offer veterans the essential understanding and assistance required to construct solid credit histories.

Veterans could think about getting in touch with local business groups or chambers of commerce that have specific resources for veterans. Discussing with other people who own businesses may offer an understanding of ways to get funds and effective strategies to build credit history. This feeling of being part of a community can be priceless when it comes to sharing advice and dealing with the special difficulties encountered by entrepreneurs who are veterans.

- Network: Build connections through local business events for shared experiences and advice.

- Resource: Many nonprofits offer specialized programs for veterans in business; explore these opportunities.

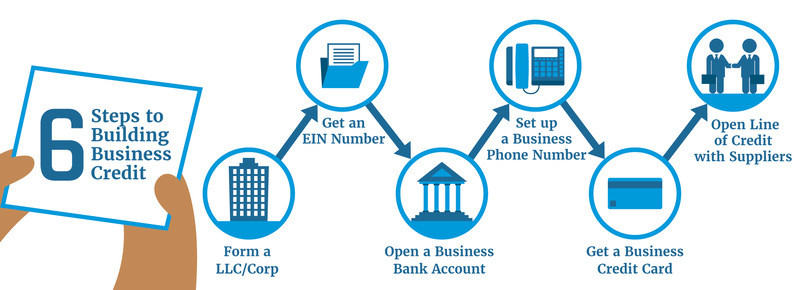

Steps to Improve Credit

To make better credit, it needs time and regular work. The people who own businesses must concentrate on many important points to boost their profile of credit. In the beginning, you need to pay your bills at the right time - this is very necessary. Delayed payments can negatively impact credit ratings. Also, lessening current debt may enhance the use of the available credit ratio, an essential factor in determining a person's borrowing ability according to credit scoring systems. Setting up credit arrangements with suppliers or dealers who notify these changes to the credit bureaus could further contribute towards strengthening a good financial history. Regularly checking credit lets the owners of a business keep up to date with their credit situation, and they can make changes if needed.

Besides paying on time, business holders need to preserve an assorted credit combination, which involves installment loans and revolving credit. This mixture can boost their credit grade by demonstrating to lenders that they have the capability of handling different kinds of credits responsibly. Using credit prudently along with keeping debts under control is essential for preserving the good health of one's overall financial reputation.

- Strategy: Consider a secured credit card for rebuilding credit if needed; it can be a useful tool.

- Monitoring: Use credit monitoring services to receive alerts on changes to your credit report.

Challenges Faced by Veteran Business Owners

Business owners who are veterans usually face certain difficulties that can make credit building complex. Moving from military life to business ownership can bring financial unknowns, and veterans might not be familiar with how credit systems work. Besides this, there could also be challenges in getting capital because people think their business ideas carry Veterans' need to use what they got during service to handle difficulties effectively. Making a helpful network can also be good for dealing with problems and finding resources that fit their needs.

A lot of former servicemen might experience prejudices from loan providers because they have mistaken beliefs about their capacity to run businesses effectively. These veterans must be well-prepared for applying for loans, offering a detailed business strategy and financial forecasts. This readiness could help lessen worries from lenders and improve their possibilities of getting the money needed.

- Awareness: Recognize biases in the lending process; prepare to address them during applications.

- Documentation: Keep accurate and organized financial records; they strengthen your credibility with lenders.

Long-Term Credit Management

After you have set up a strong credit base, it becomes necessary to keep managing your credit. Those owning businesses must never stop learning about how to handle their credits and be active in maintaining the health of their credit profiles. Meeting with finance advisors or those who counsel on matters of loans can give helpful thoughts and plans for success that last long into the future. Business owners who frequently go back to their Experian credit report can watch over their credit health and make sure they are acting in a way that protects and improves their good reputation regarding credits.

The practice of forming a habit to set financial targets can help in managing credit for the long term. By putting forward objectives for short and long periods, entrepreneurs can make practical plans to enhance their credit gradually. This method motivates a structured way towards finance management and promotes ongoing learning about credit.

- Goals: Set specific credit improvement goals with timelines to track progress effectively.

- Review: Schedule regular reviews of your financial health to adapt strategies as needed.

Conclusion

To summarize, experienced business owners need to construct powerful credit. They can use tools like the Experian credit report and access different resources available to them as business owners to have solid credit profile that helps their entrepreneurial activities. By knowing how important credit is and managing it actively, there are more chances they will succeed and grow in the world of business.

-

Mortgages Jan 12, 2024

Mortgages Jan 12, 2024December 2022's Top Providers of Home Equity Loans

Homeowners can use the home equity as collateral for a loan. To calculate your home's equity, subtract your mortgage balance from the home's current market value. Home equity loans are popular among borrowers who want to make home improvements and those who want to pay off or consolidate high-interest debt

-

Mortgages Nov 10, 2023

Mortgages Nov 10, 2023Understanding Clear to Close and Final Stages of Homebuying

The Timeline Clear is a crucial step in preparing for the closing day, ensuring all necessary steps are taken, and a clear to close is established.

-

FinTech Sep 04, 2024

FinTech Sep 04, 2024Top 10 Online Banks to Consider for Convenient Banking in 2024

Online banks like M and T online banking need technology proficiency, but they offer comprehensive customer support to resolve concerns and reasonable minimums.

-

Business Sep 30, 2024

Business Sep 30, 2024Building Strong Credit as a Business Owner

Find out how an experienced business owner creates credit with Experian and uses precious resources for achievement.