Klarna: Definition, Functions, Benefits

Oct 12, 2023 By Susan Kelly

Klarna was established in 2005 and is headquartered in Sweden. It has approximately 90 million worldwide customers and executes 2 million payments daily. There are several online marketplaces like Klarna that offer this sort of funding. People are more comfortable making purchases immediately but delaying payment till later. One poll found that 39% of users have been using short-term or installment mortgages at the point of transaction.

Operations of Klarna

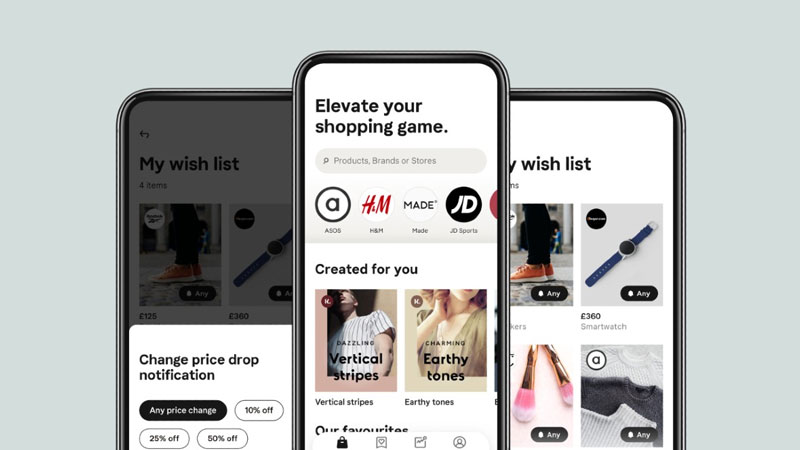

Klarna is a platform that allows customers to make purchases immediately but defer payment until a later date. You may purchase with Klarna from anywhere, but all you need to do is go online by using the Klarna smartphone application or by selecting Klarna as one of your financing options when you check out with participating locations.

If you decide not to use financing for your transaction, investment returns are not required, and you have various options for paying back what you need.

For Instance, you may cover the full purchase in thirty days with no interest, pay the balance in four attention payments, or lease it for a time ranging from six months to three years.

Klarna has a requirement that you have to purchase at least $10. There is no predetermined cap on the amount of credit you can have. Rather, the user may examine the application's "Purchase Strength" section to get a rough idea of the amount of money that is now available for spending. The limitation is determined by several variables, including monthly payments and the total balance.

Your Real Purchasing power will probably increase according to the frequency you use Klarna to make payments and the promptness with which you refund the money you borrow.

Costs and Interest Associated with Klarna

Either you select the Payment method in 4 or Payment method in 30 Day choices, Klarna will not cost you any interest fees. If you can repay the total amount you pay within the specified amount of time, you won't be charged any interest on any of these purchases now and will pay later mortgages.

Payment Options Available at Klarna

There are multiple benefits of using Klarna, among which a significant advantage is that it has two choices for its BNPL, which is also referred to as Buy Now, Pay Later service that is both interest-free and service charge:

Pay in 3

You will not be charged any interest or fees if you choose this alternative to pay for your purchase throughout three equal installments. You will be required to make the initial payment at the time of purchase, and subsequent payments will be deducted from your account every month.

Pay in 30 days

When you use this alternative, you can have thirty days following the delivery of your items to make the payment for those things without being charged any interest or other fees. This implies that if the things are not what you anticipated or required, you may return them without any of the money you paid for them coming out of your checking account.

When you purchase using BNPL services, we undertake rigorous eligibility evaluations upon every transaction. These evaluations include a light credit report, which does not impact your credit rating. This implies that we take an up-to-date look at another's financial state in order to ensure that we only provide money to people who are in a position to repay us conveniently.

When your time of payment arrives, we will ensure that you are aware of the upcoming deadline in advance. Through the use of our Klarna application, you will have the possibility to pay off your amount sooner than the deadline, or, if you require some extended time, you will have the option to renew the deadline (free of cost) and receive ten more days to make your payment. You can request a deadline extension just once for each order.

When you use BNPL services, you will never pay a higher total amount than the original cost. If you got late with a payment, BNPL will contact you to request restitution; however, you won't be subject to any late payment fees or interest, and your credit rating will not be affected. If you are having trouble making payments, we have a staff devoted to serving vulnerable customers who can assist you in finding a payment plan that meets your needs. However, if you become late with your purchase, we will have the right to limit your access to our services.

If you tumble and cannot reach you to work out a payment arrangement, we will forward your information to an agency that collects debts. Your credit rating will not be impacted, and you won't incur further Klarna fees or accrued interest. Debt recovery firms are the only ones we've ever used to assist us in staying in touch with past-due consumers. We do not ever sell past-due balances on these items to debt collectors. As a result, Klarna is in complete charge of handling the debt. Our debt collectors, nor do we make use of bailiffs or enforcement officers.

Financing of Klarna

For the acquisition of costly things, we provide a standard regulated lending product with payment terms ranging from six to thirty-six months. According to the store, you may be able to get zero-interest or interest-bearing loans. A maximum rate of return of 18.9% is applied, although the overwhelming majority of Klarna finance sales do not incur any interest.

Pick a monthly payment schedule that works best if you apply for financing during checkout. If there is an interest payment rate, you will be aware of this before filling out the application. If accepted, you will get a quick response and may start processing the order immediately. Doing so requires a thorough investigation of your credit history, which might lower your score.

-

FinTech Sep 22, 2024

FinTech Sep 22, 2024Epic Systems Introduces 100+ AI Features for Healthcare Innovation

With more than 100 new AI features, Epic Systems is improving healthcare by increasing productivity for physicians and patients.

-

Know-how Jan 25, 2024

Know-how Jan 25, 2024Decoding the Russell 2000 Index and its Impact on Small-Cap Stocks

Explore the world of small-cap stocks through the lens of the Russell 2000 Index. How this index works, why it matters, and the exciting opportunities for investors.

-

Know-how Oct 07, 2023

Know-how Oct 07, 2023Retirement gift ideas for everyone in your life

Make sure to give the perfect retirement gift for your loved one’s special day! From unique experiences to traditional gifts, here are our top picks for retirement gift ideas for everyone in your life.

-

FinTech Sep 08, 2024

FinTech Sep 08, 20245 Essential Social Marketing Tips for Fintech Startups in 2024

Optimize your social media profiles with social marketing and collaborate with influencers to grow your target audience and boost your FinTech company.